Why Home Builder Stocks Represent Great Buying Opportunity

jimfeng/E+ via Getty Images

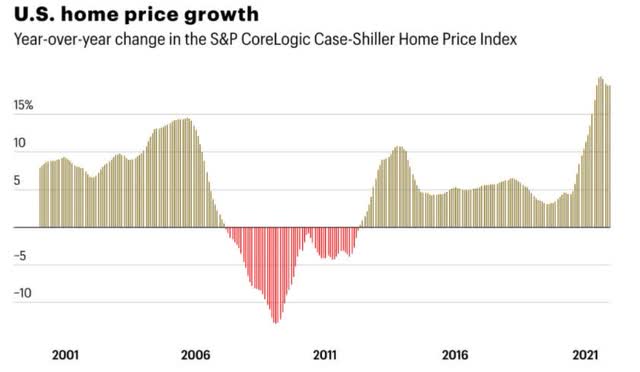

The amount of negativity around the housing market seems to be everywhere these days. The headline reason is around affordability, as home prices have flown higher over the past 2-years, and now mortgage rates are approaching 5%. Many are now coming to grips with the fact that the growth in home prices could slow dramatically. However, that dramatic slowdown would see home price growth simply returning to historical norms of 4-5% a year as visualized below:

Fortune.com

Housing stocks, specifically homebuilders, are trading as if we are headed for a housing crash with massive declines in home prices and the volumes of new homes sold. It would seem however that the reality is something entirely different.

There is a nationwide shortage of homes for sale. You can’t really find anyone who will dispute the housing shortage today in terms of homes listed for sale. There is a desire for homeownership that the U.S. has not seen in decades. There are fundamental changes due to COVID such as increased mobility, work from home trends, desire for investors and individuals alike to own a rental property, desire to own a vacation home, and simply an increased awareness of the importance of where and how families live that will not quickly dissipate.

The largest demographic group in the U.S. is the Millennial generation. This cohort is 70M+ strong and the oldest Millennial is around 40 years old while the youngest is around 25. These buyers are entering their prime home ownership years against the COVID backdrop of understanding the importance of how and where they live. Millennial home buying, regardless of interest rates, will be a significant driver of housing for many years to come. Why? Because rental rates for single family homes and apartments have spiked due a lack of supply and overwhelming demand. When given the choice of renting a housing unit where rental costs could continue to move higher over time the idea of a fixed housing cost (with a mortgage) sure does make a whole lot of sense. Millennials have seen their wealth on average increase by 50% over the past 5 years. They are entering the peak earnings season of their lives given them ample opportunity to have increased wages over time and feel comfortable with having a higher cost of housing than they might otherwise have had a few years ago. Rising wages are not talked about enough in terms of housing. Consider the example of financing a $500,000 home at a 4% interest rate versus a 5% interest rate. The incremental cost of rates moving to 5% would mean that buyers are paying $5,000 a year more for their home. That is real money and I won’t diminish it. However wages are sky-rocketing as well. A family with an income of $100,000 a year who is likely to see consecutive years of 5% wage increases would accumulate $10,000 in additional annual income over a 2-year period. While it is not fun on paper to see the cost of a home, in the above example, move $5,000 higher with rates increasing the fact is that most buyers are aware of how much higher their wages are moving as well.

How about that housing shortage and is it just a temporary shortage that will quickly go away over time. Ivy Zelman is a housing analyst who boldly, and correctly, predicted the housing crash almost 15 years ago well before anyone else. Ivy is on record now warning about the housing market. Her biggest contrarian call today is that there is not really a housing shortage. The housing market bulls, and most statistics, would emphatically tell you there is a shortage of housing. Ivy’s opinion in this article is that 2nd home demand, investors, BFR buyers, i-buyers, and other forces are seemingly temporarily impacting supply while driving up pricing. Of note, in that same interview and article referenced above, the following quote was attributed to Ms. Zelman:

A modest rise in 30-year mortgage rates, even to 4%, would bring demand to a halt, according to Zelman.

Well rates have sky-rocketed past 4% and there are some headlines about modest slow-downs in pending sales and mortgage applications.

But, homebuilders give us real-time updates by way of their quarterly earnings reports. Just in the past 2-weeks we have heard from Lennar (LEN), the 2nd largest builder in the U.S., and KB Home (KBH). Neither builder has noted any type of slowdown. On the contrary, both builders are still deliberately limiting sales. Said another way, both builders are telling prospective buyers who come in to buy a home, that they will not or cannot sell them a home at this time because their demand outstrips the current capacity of the supply chain to build a home. Both the Lennar and KB Home earnings calls took place in the 2nd half of March. Mortgage rates had already moved steadily past 4% and were marching closer to 5%. Both builders indicated no slow-down in demand. I believe the bearish argument to be that the strong demand in the face of rising mortgage rates is just a last gap of buyers wanting to purchase before mortgage rates move even higher. I do not believe that bearish argument holds up when you consider that builders are still limiting sales and have waiting lists for buyers who want to purchase a home as soon as they will sell them one.

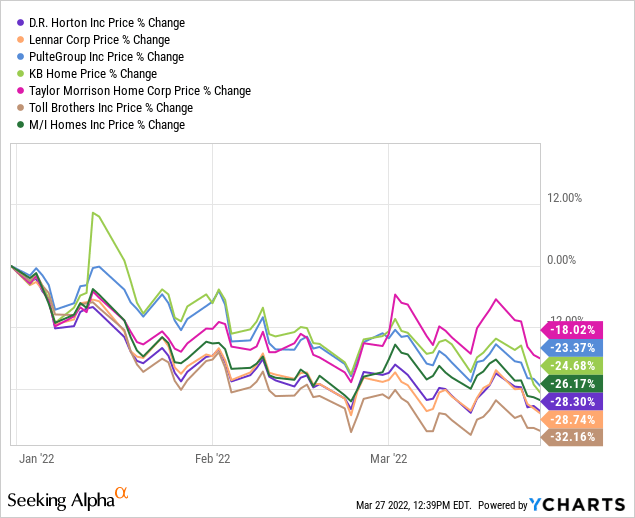

To be clear, Ivy does not appear to be calling for a housing crash, she is preaching caution while still projecting home prices to grow in 2022. The breadth of her firms insight into the housing market, and her general cautious tone, is very likely to be weighing on homebuilder stocks. Ivy also is clear to note that her caution could be early and that even if she is right a housing slowdown might not yet play out for an extended period of time. Here are two charts showing the decline in builder stocks:

The first chart shows builder stocks down on average about 25% since the beginning of 2022. Not that surprising given the general bearish market sentiment, but as a group, home builders have continued to see their stocks decline even as the market has rallied.

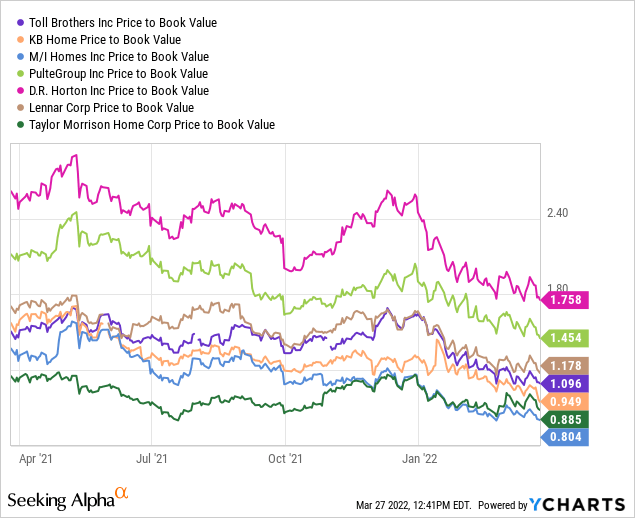

The second chart shows the decline in their price to book value multiples:

Price to book value has long been the leading valuation to determine if builders are over or undervalued. Builders own land and have an asset base that is fairly easy to value. If you own land at a fixed price, in a rising home price environment, then your should have a higher book value as you will monetize that land at a much higher price than you own it for. If you own land at a fixed price, in a decline home price environment, then your book value could be at risk of being overstated.

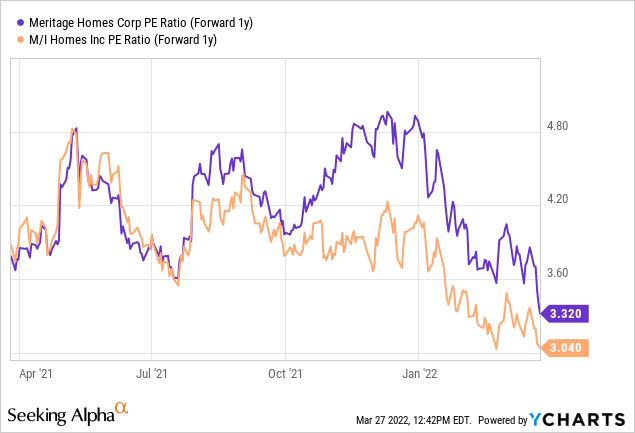

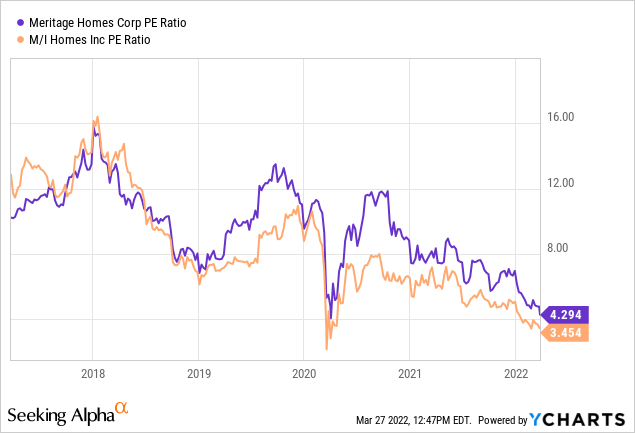

One final chart below showing my favorite two homebuilder stocks to own and their forward PE valuations:

Consider for a moment that these two companies, Meritage (MTH) and M/I Homes (MHO), are trading at forward PE multiples of just over $3 per share based on analyst estimates for 2022. Also consider that both builders have already sold (sold by not yet closed), by the end of Q1 2022, likely 70%+ of the homes they will close this year.

Said another way, if the housing market didn’t correct, these companies would generate earnings equal to their current market capitalization in just over a 3-year time period. For perspective, the below shows the historical PE valuation these two builders have previously traded at:

You could buy Meritage or MI Homes at the cheapest PE valuation, today, than you could at any time in the last 5-years. The question for investors on these two companies, and many others in the space, is whether the market is correct in effectively assuming that earnings beyond 2022 will drop by 50% or more. In case it is not obvious, for that to happen, there would have to be both a significant decrease in home prices and a significant drop in the number of new homes sold. With record low inventory of homes for sale it is very hard to imagine a scenario where this could happen. Let’s use Meritage Homes as an example who I previously profiled. Back in July of 2021, I suggested that the market was not assuming enough EPS growth for Meritage heading into 2022, and estimated that the company should see earnings of around $24 per share in 2022. The market is now assuming slightly above $24 in EPS in 2022 which supports the guidance provided by the company. With Lennar having just reported the companies Q12022 earnings, and raising 2022 EPS guidance, I suspect that Meritage will actually earn over $24 a share in 2022. The stock is trading at just under $83 per share and is an absolute steal at these prices. However, the market is obviously pricing in a sharp deceleration of future earnings. If you assume that the market does significantly decline, let’s assume Meritage sees 2023 earnings fall to $12 per share and be cut in half. At a share price of $83 MTH is still trading at less than 7x what you could then call normalized earnings. That is still well below the EPS multiple that Meritage has seen over the last 5-years. Meritage ended 2021 with ~$3B of stockholder equity and ~32M shares outstanding. The company had a book value of ~$80 per share at the end of 2021. Should Meritage earn $24 a share in FY 2022 as their guidance, and the analyst community suggest, the company would end FY 2022 with a book value per share of almost $104. You can buy this company today at more than a 20% discount to their estimated 2022 year-end book value.

As I will detail in another article, MI Homes is likely trading at a 40% discount to their estimated 2022 year-end book value, and is currently my favorite investment in the homebuilder space.

The Final Takeaway

Rising mortgage rates are crushing the homebuilding stocks and leading to a slew of negative headlines and general concern that housing has peaked. The reality is that builders, and buyers, would love to see home price gains slow dramatically. The supply chain is effectively broken which almost every builder CEO notes during earnings calls. Demand still outstrips the supply of homes that can be built, so if the Fed succeeds in slowing the housing market, this is actually a positive outcome. Demand should equal supply, and right now, demand is far outstripping supply.

The cost to construct a new home has risen rapidly driven by supply chain snarls. As the world-wide economy reopens and supply of materials increases these costs increases should moderate. The cost of lumber has likely risen by $20-30K per home. Lumber price increases are not sustainable and just in the past few weeks lumber futures have fallen by almost 30%. Consider the following example – Lennar has estimated that the company will generate gross margins of about 28% in FY 2022 on an average selling price of almost $500,000. At a 5% interest rate buyer would pay $25,000 a year interest and at 4% the annual interest cost was $20,000. At a 4% interest rate from a few months back there were very few concerns about the housing market. Let’s assume that demand does slow and that buyers could really only afford to pay $22,500 a year which would mean, in the Lennar example, home prices go down to $450,000 with a 5% mortgage. Investors are not considering that if demand were to slow, a significant amount of the construction cost increases would reverse, offsetting any decline in home prices. Assume house costs were 45% of the Lennar ASP of $500,000 or equal to $225,000. Assume those house costs were to decrease by 10% or $22,500 to offset a $50,000 decline in home prices. Then assume that Lennar has 3% of SG&A tied to commissions and other variable costs associated with home prices which would be another decrease of $1,500. In this example, Lennar would go from making 28% on a $500,000 home ($140,000) to making $114,000 on a $450,000 home for a 25.3% Gross Margin. That level of margin is still well above historical norms and is reflective of how the run-up in home prices has been offset by a run-up in costs. If the rise in prices is not sustainable, and the rise in building/demand is not sustainable, then there will be a massive corresponding decrease in construction costs as well to offset a price decline.

I also do not believe that average investor understands what a rising rate environment means. Rising interest rates signal that inflation is running high and that the economy is strong. A strong economy is positive for housing and moderate inflation is generally positive for all real assets.

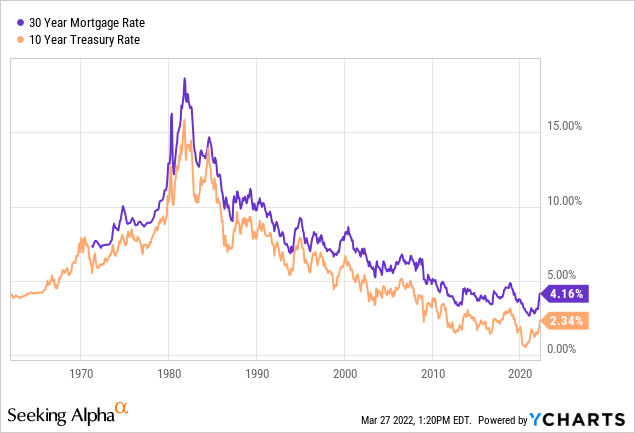

The Fed has been crystal clear that they will raise interest rates. Does the average investor know what this means? Mortgage rates are generally priced off the 10-year treasury yield (at a premium). Treasury yields are already higher in anticipation of the coming rate hikes. As you read scary headlines about 50bps Fed Fund rate hikes, this does not mean that mortgage rates will spike 50bps higher when the Fed acts. Treasury yields are already reflecting the impact of the coming Fed rate hikes.

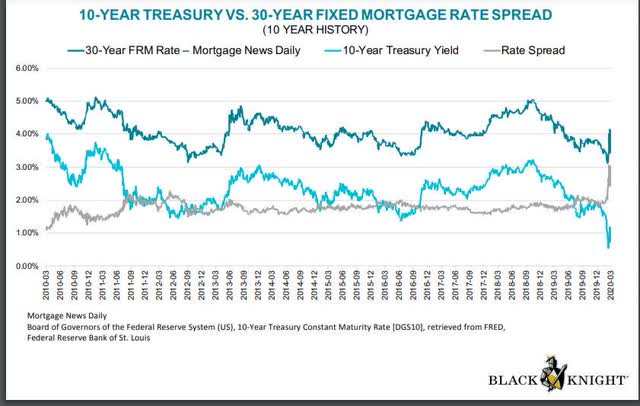

The chart below is a great example of how investors should think about mortgage rates when compared to the 10-year treasury yield:

Treasury vs. Mortgage Rate Spread (Blacknight)

Going back over the last decade, there have multiple instances of the 10-year yield exceeding 3 percent and where 30-year mortgage rates have never really exceed 5%. Today, the 10-year yield hovers around 2.5% while the 30-year mortgage rate has rocketed to almost 5%. Looking at the chart below, it is pretty obvious that as a whole, yields are on a permanent downward trajectory (and thus mortgage rates will be as well). Technology and innovation will continue to have massive deflationary impacts on society and yields should reflect that over time. We have massive inflation today due to an exogenous event (COVID), massive monetary stimulus, and the unprecedented impacts on the supply chain. Over time, the stimulus will leave the system and the supply chain will rebuild, which should normalize everything.

The seminal point on mortgage rates is that it is very likely they have peaked or will peak soon now that they are around 5%. The historical 10-year yield and 30-year mortgage rate spreads tell us that.

As mortgage rates plateau we will quickly find out if the housing market is impacted. Builders are selling homes, today, at the current mortgage rates. If they do not see significant adverse impacts to their businesses in a very short amount of time I expect to see a massive move higher in all of their stock prices. People want to buy homes. There are a record low number of homes to buy. Life events happen, the impacts of COVID are still driving the housing market, and demand exceeds supply. There is no doubt that higher interest rates and decreased affordability will drive some potential buyers out of the market. However, for equilibrium to be obtained and home price appreciation to slow (not decline), this needs to happen. Sustainable home price increases at much lower levels and a realization that household formation demand exceeds the supply of available homes is a huge positive for the housing space.

I expect that this realization will dawn on the market soon and there is significant money to be made when it does. If I am wrong, and the Fed has to hike rates significantly higher that the market assumes, I would much rather own a builder trading significantly below book value than many other parts of the stock market (like unprofitable technology companies).

Stay tuned for a coming article on why MI Homes, trading at below .6x my projected ending 2022 book value for the company and less than 3x 2022 projected EPS, is a screaming buy at its current price.