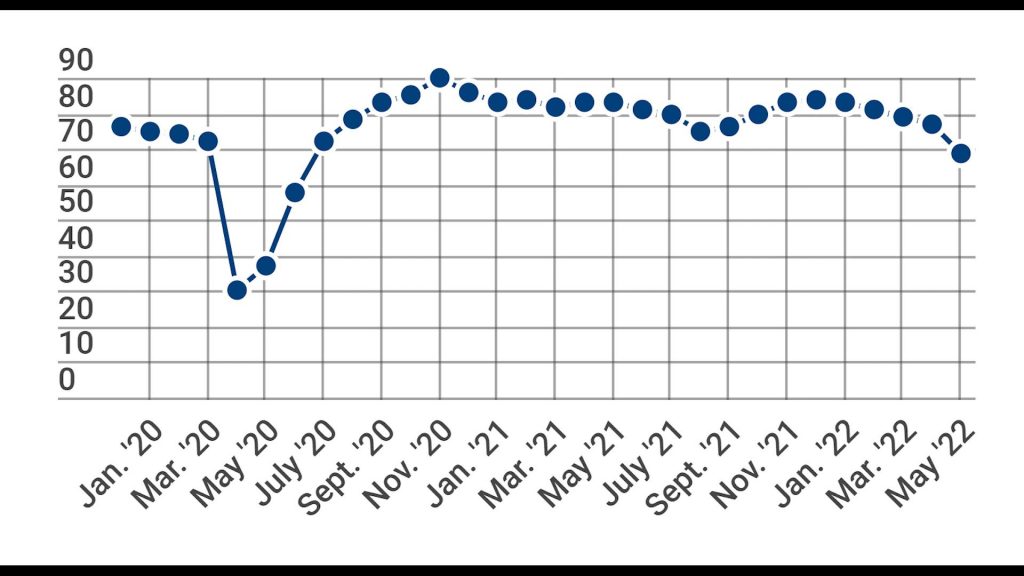

National home builder confidence drops to two-year low

SALT LAKE Town — For the fifth straight month, nationwide dwelling builder self-confidence fell, according to the Nationwide Affiliation of Property Builders/Wells Fargo Housing Market Index.

The index fell 8 factors in Might to 69 — the least expensive degree for builder assurance for new, solitary-family members houses given that June of 2020.

“The housing market place is facing rising worries,” mentioned a well prepared assertion from Robert Dietz, the residence builder association’s chief economist. “Building material expenses are up 19% from a year ago in less than 3 months, property finance loan costs have surged to a 12-year high and based mostly on recent affordability ailments, much less than 50% of new and current household revenue are cost-effective for a common relatives.”

Dietz went on to say that entry level and first-time customers are battling the most with the sharp boost in mortgage loan prices.

The Nationwide Association of Dwelling Builders has carried out the regular monthly study for more than 35 many years. Any range in excess of 50 implies that far more builders perceive industry conditions as great than lousy.

The survey asks about three spots: present-day profits of new residences, expectations for income over the upcoming 6 months, and traffic of possible prospective buyers. All a few locations dropped in Could.

“Housing prospects the company cycle and housing is slowing,” claimed the association’s chairman Jerry Konter in a press launch. “The White Household is finally obtaining the concept and yesterday unveiled an motion approach to address soaring housing costs that emphasizes a very crucial element very long-advocated by NAHB — the need to have to develop a lot more households to relieve the nation’s housing affordability disaster.”

Wells Fargo senior economist Mark Vitner explained to KSL Television that the study however reflects a nutritious market but also exhibits there are expanding worries from residence builders.

“I feel the large takeaway is that fascination premiums have risen quicker than men and women envisioned and into a higher stage, and it is taking a little bit of a toll on the housing industry,” Vitner stated.

Vitner stated initial-time homebuyers are nevertheless extremely active in the housing market, even even though affordability has been as difficulty for some time.

“With growing interest fees, people are anxious that desire is not likely to hold up, but right now, that’s not a problem, and which is especially the case in Utah where the economic climate is so a lot stronger than it is in the state as a full,” Vitner said. “The desire for properties in Utah is far outpacing the offer that builders can supply correct now.”

The Salt Lake House Builders Affiliation explained Utah’s financial state is robust.

“Here in Utah, the fundamentals are sound,” explained Jaren L. Davis, executive director of the Salt Lake Property Builders Association.

But Davis mentioned there are symptoms that the housing marketplace is going through some improvements.

“Our builders are seeing decreased visitors,” he reported.” They’re seeing, maybe, an boost in the number of cancellations in contracts, but what that is having us to is additional of a standard marketplace.”

Davis stated Utah’s ongoing housing scarcity and escalating population really should retain demand high.

“Builders nonetheless have big lists of people today that are interested in their homes,” Davis reported. “So probably some slide off of that and it’s possible some contracts drop out of position, but somebody is currently being place back again in the slot pretty promptly.”

Nationwide builder sentiment is far better in the west, with the region’s three-month transferring normal dropping 6 factors in May perhaps to 83.