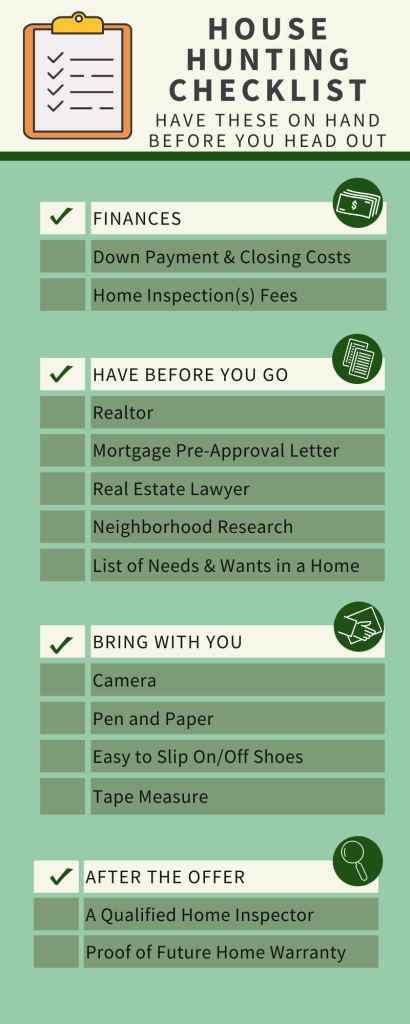

House Hunting Checklist: What To Have When Looking for a New Home

Dragon Pictures / Shutterstock.com

It’s at last happened: you are prepared to settle down and come across the great property for yourself and/or your family members. Ahead of you go out house hunting, however, you want to make positive you have almost everything in purchase to make the process as smooth and straightforward as is probable. Right after all, this is most probably the greatest acquire you’ll ever make, and a prolonged-term determination.

See: 7 Monetary Routines That Make improvements to Your Each day Lifestyle

Obtain: 20 Residence Renovations That Will Damage Your Home’s Value

Our house hunting checklist assists you program for every little thing, from the finances and people you have to have on your crew, to the objects to deliver with you when you start out your search.

Finances

Down Payment and Closing Prices

Most persons know that they’ll require to set a down payment on a household — a portion of the price of the dwelling due up front. How a lot you set down impacts how substantially you are going to pay back regular, as a house loan. Since houses price tag in the several hundreds of countless numbers to thousands and thousands of dollars, even a 10% down payment can insert up to a ton of funds. Dependent on your point out, county, and the variety of home finance loan you qualify for, you may perhaps have to arrive up with, on regular, any where among 3% and 20% of the full property finance loan, in accordance to Investopedia. There are some initial time homebuyers’ applications that can assist with this, or restrict your down payment, so seem into those initial.

But that’s not all! There are also closing charges, the service fees you shell out your lender to build the financial loan for you, according to Rocket Mortgage loan. These costs normal about 3% to 6% of the property price. So if you ended up to choose out a house loan really worth $400,000, closing fees would be anywhere from $12,000 to $24,000.

House Inspection Charges

If you’re blessed more than enough to have your provide on a home acknowledged, you then have to spend for the value of a home inspection, and a variety of other inspections or tests relying upon hazard elements. The national common for a home inspection is $340, though it can be a little significantly less or much more, in accordance to Household Advisor. Other feasible inspections, in accordance to Rocket Residences, could include termite inspection, asbestos, mildew, or direct tests, a foundation inspection, septic tank inspection, sewer scope or radon testing. Every of these assessments can run from $100 up to $1,000 based on who you employ.

Have In advance of You Go

Realtor

There’s 1 professional you really do not want to try to order a home with out — a authentic estate agent. It is their job to do a number of significant factors most people do not know the initially point about. Not only will they exhibit you houses primarily based on your requirements, when you find 1 you want, they’ll set in your offer you and translate any requests to the vendor. They’ll assist you established up your inspections and other thanks diligence, file all the needed paperwork and guidebook you as a result of the escrow system. You’d be missing without the need of one particular.

Mortgage loan Pre-Acceptance Letter

In advance of you even commence to search at households to obtain, you will need to know how significantly you can pay for to shell out in a regular property finance loan primarily based on your income. House loan lenders will operate your details and generate a mortgage loan pre-acceptance (or pre-qualification) letter that estimates how massive of a mortgage you can comfortably acquire out, according to the Customer Money Safety Bureau. Even though it’s not a guarantee, it does make a prospective seller additional very likely to settle for your give.

Be Very careful: 10 Signals You Must Not Purchase a Property Right Now

Real Estate Attorney

Based on the place you are living and the kind of obtain you’re making, you may possibly will need to seek the services of a actual estate legal professional. These attorneys know how to draw up and critique legal files that may perhaps be vital in the purchase of a property. On the other hand, not just about every obtain needs a person, in accordance to Rocket Mortgage. Your true estate agent or mortgage loan provider will enable you know if you require just one.

Neighborhood Study

Merely going for walks previous a house you want to buy is in all probability not more than enough to master all you require to know about it. You will want to put in some neighborhood investigation to establish if it fits your wants. Internet sites like AreaVibes and Neighborhood Scout can give you data on crime rate and normal neighborhood demographics, as perfectly as neighborhood teams like NextDoor.

Record of Needs and Desires in a Residence

The much more certain you can get about what you want vs . what you have to have in a property, the a lot more likely you are to locate a home that overlaps concerning the two lists. MoneyUnder30 endorses you start out with your desire house and function backwards, carving out items that you can are living without having and cementing the issues that are offer breakers.

Products To Provide to Property Showings

When you go to an open up home for a home, there are some important things you are going to want to provide with you for useful functions. A camera, so you can get photographs of components to recall later on a pen and paper to write down important information (or a mobile phone/tablet) sneakers that you can effortlessly slip on and off as some properties may have a no-footwear policy and a tape evaluate so you can be positive that key pieces of home furniture or appliances will suit in the essential spaces.

Immediately after The Offer

As described above, you’re likely to have to have to pay out for an inspection, if not quite a few, and the time when you will truly need to have to do so is right after your present has been acknowledged. Acquiring one particular might not be as basic as relying on your realtor, in accordance to Buyer Stories. Realtors are usually in a hurry to “close the deal” and might not have the most effective particular person for the best value. Depend on term of mouth from pals, Yelp or Home Advisor, they suggest. Make certain your house inspector has credentials, and that their rate compares with heading premiums.

You also could choose to obtain a residence warranty when you acquire a house. A property warranty covers repairs or replacements of significant ticket merchandise these types of as appliances and main systems in your residence, and can be customized, in accordance to Creditful. These warranties charge a number of thousand bucks up-front, in accordance to Investopedia, and ordinarily cost a price for each time a repair service individual is called to appear out and deal with some thing, which could be an additional $100 or a lot more for each go to. Nevertheless, preserve in intellect that not all warranties will include all forms of difficulties, and you may well in no way even need to consider benefit of it.

Extra From GOBankingRates