The Mortgage Bankers Affiliation (MBA) Builder Software Study (BAS) data for Oct 2021 has found that applications for new household buys lowered 15.2% yr-over-yr, however rose 6% around September 2021.

The Mortgage Bankers Affiliation (MBA) Builder Software Study (BAS) data for Oct 2021 has found that applications for new household buys lowered 15.2% yr-over-yr, however rose 6% around September 2021.

“Applications for new residence purchases in Oct had been down 15% from a year back, but exercise was 6% bigger than in September,” mentioned Joel Kan, MBA’s Affiliate VP of Economic and Industry Forecasting. “The sturdy monthly acquire places MBA’s estimate of new dwelling gross sales at its strongest pace because January 2021.”

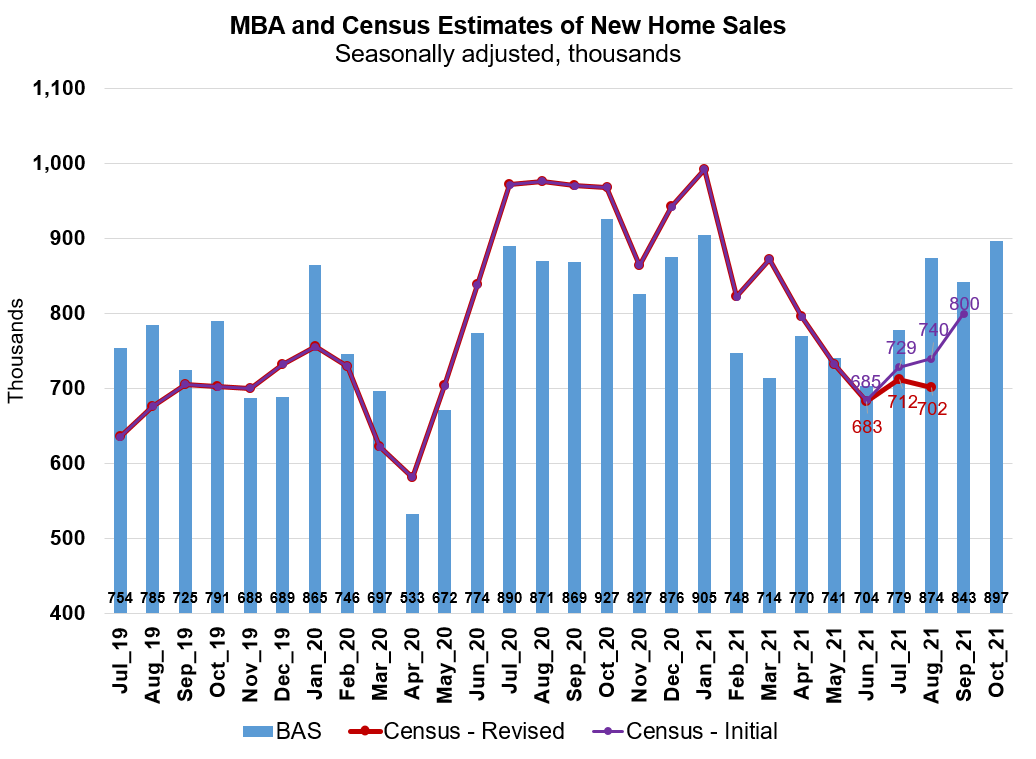

The MBA estimates that new single-spouse and children home income had been managing at a seasonally adjusted yearly amount of 897,000 models in October 2021, based on details from the BAS—which tracks application quantity from house loan subsidiaries of residence builders throughout the state. MBA’s estimate is derived employing property finance loan software data from the BAS, as perfectly as assumptions concerning current market coverage and other things.

As supply and demand imbalances proceed to result in challenges for potential potential buyers, CoreLogic’s a short while ago issued Household Value Index (HPI) and HPI Forecast uncovered that the need for the short offer of properties outlined remained reliable by way of the end of the summer time, driving rates upward 18% 12 months-in excess of-year in September.

“Purchase exercise proceeds to be dominated by better financial loan harmony transactions, which pushed the average new home personal loan dimensions up to around $412,000, one more new report in the survey,” stated Kan. “Recent U.S. Census details show an rising share of new gross sales are for households still to be constructed or even now underneath design, and a shrinking share of finished households. Housing desire remains powerful, and buyers are building fast choices in a continue to extremely competitive sector.”

U.S. Census Bureau and the U.S. Department of Housing and City Advancement (HUD) results on new privately‐owned housing models licensed by setting up permits in Oct were at a seasonally altered once-a-year fee of 1,650,000, 4% previously mentioned September’s charge, and 3.4% previously mentioned the Oct 2020 charge of 1,595,000. HUD and Census Bureau claimed that single‐family authorizations in October had been at a price of 1,069,000, 2.7% higher than the revised September figure of 1,041,000.

“While groundbreaking on new household homes slowed in Oct, housing permits–a leading indicator of long run starts—increased to an annual rate of 1.65 million, which is a good signal that house building is starting to accelerate to continue to keep up with the speed of home development,” mentioned Odeta Kushi, First American Deputy Main Economist. “Single-relatives permits, even though nonetheless down from pandemic highs, are almost 6% increased than pre-pandemic (February 2020). Yet the variety of single-loved ones households permitted, but not begun increased this month and is 43% larger in comparison with one calendar year back, at explain to-tale signal of ongoing offer chain troubles.”

The MBA studies that the seasonally adjusted estimate for Oct is an enhance of 6.4% from the September rate of 843,000 models. On an unadjusted foundation, MBA estimates that there have been 68,000 new dwelling profits in Oct 2021, an increase of 3% from 66,000 new household income in September.

“Homebuilders nonetheless confront delays and problems from offer-chain bottlenecks and increasing fees,” stated Kan. “Overall development charges, as measured by the Producer Value Index (PPI), recorded an yearly maximize of 12.3% in October, which is pretty much 5 instances the typical annual alter.”

As Kan observed, builders carry on to aspect mounting fees and price ranges as they handle their pipelines to account for offer chain difficulties, which are getting handed on to customers. Redfin a short while ago claimed that the median selling price of residences offered in October 2021 was $378,700, up 13% calendar year-about-12 months.